Why insurance is not

risk management

Written by Eric Petersen, CIC

“I practice risk management. I buy insurance.”

It’s staggering how many times I hear that phrase and unfortunately it is equivalent to “locking our gate is the only thing I can do to prevent theft of my inventory”

Simply put, insurance is NOT risk management. Insurance is a part of a successful risk management program, but should never be considered to be your entire source of risk management. Just like locking the gate is part of preventing theft, it is by far not the only way to secure the inventory on your lot.

There are five steps to the risk management process and, as a business owner, you subconsciously use these steps every day. Sadly, because many dealership owners are not programmed to consciously think about these five steps, they miss some of these steps when looking at their own business. This article is meant to help you apply the risk management process to your business so you are not left relying solely on insurance to protect all of the hard work you’ve put into your business.

- Risk Identification – It starts with understanding the potential risks: what could possibly go wrong? The identification of potential risks can be done in a number of ways; a few examples are by using checklists, surveys, or interviews with employees and other industry professionals.

Business Owner Action – Think about your physical lot, liability concerns to other people, your internal team and the business’ income to identify where the exposures are in your business.

- Risk Analysis – For each risk that was identified, what is the likelihood of it actually happening and how severe of a situation will it cause? The frequency and severity of your risks will help you understand where to spend your time and money in preventing these risks.

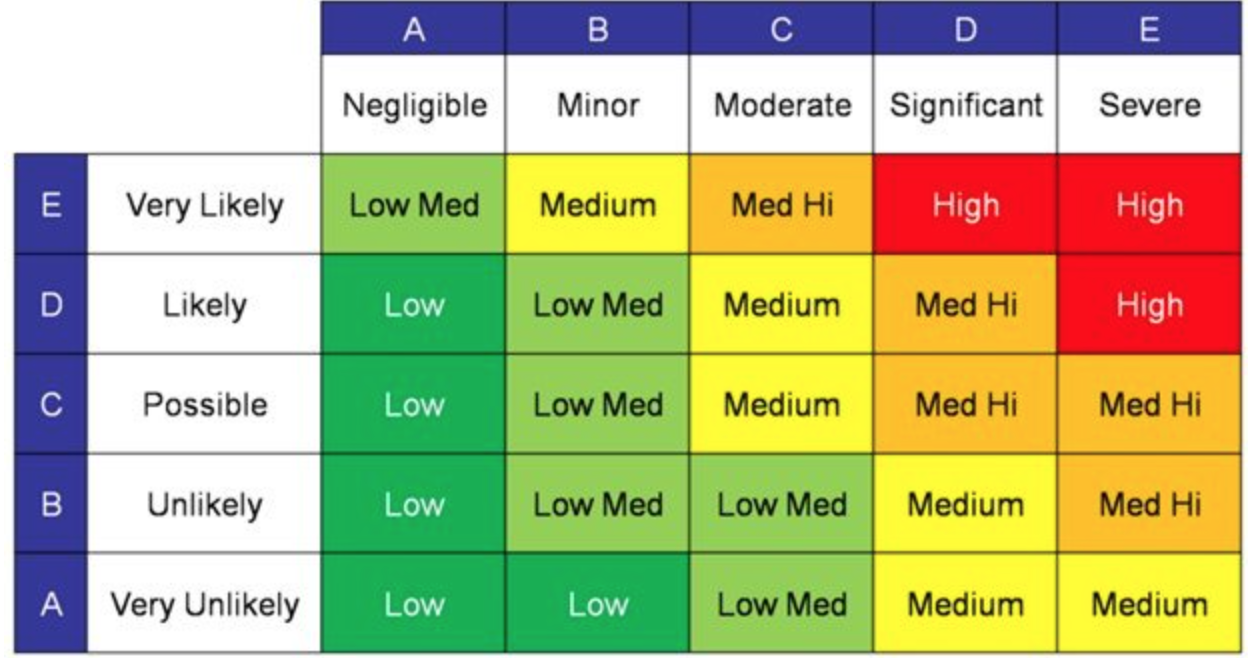

Business Owner Action – For each of the risks that you have identified, ask yourself, if this happened, how much would it impact my business? Making a Risk Map, where you put Severity on the top and Frequency on the side, will help you focus on the risks that will disrupt your business the most.

- Risk Control – Once you know the likelihood and potential severity of your exposures, you need to create a plan to control those risks. Each risk can be addressed either by avoiding it all together, retaining the exposure or assuming the loss yourself, reducing the loss by trying to prevent it from happening, or lowering the impact by being prepared before it happens and transferring the risk to someone else.

Spoiler Alert: Insurance doesn’t come into the picture until you want to transfer your risk to someone else!

Business Owner Action – Your goal is to minimize the risks to your company at the optimal cost. Strengthening your lot security is a great risk control method. Creating a hiring and recruiting plan to employ the very best employees can limit the potential for employee issues or lawsuits. Understanding your company’s financial strength and where you can self-insure or retain the small things that come up everyday is critical in this step.

- Risk Financing – We finally get to the point in the process where we talk about insurance! The decision as to how the risk will be paid for is made. Do you want to assume the risk and control it some way or do you want to buy insurance?

Business Owner Action – When looking at your Risk Map, most dealership owners are willing to self insure or assume the financial risk of the low severity incidents. Anything that is in green in the above chart typically is self insured. The yellow and red items are things that pose a greater risk to your business’ overall financial health. Insurance is purchased for these risks.

- Risk Administration – The last step in the risk management process happens after all of the planning and decisions have been made and when the plan is implemented. Part of this step is also to assess the effectiveness of your actions to improve upon your overall plan in the future.

As a Business Owner – You begin to implement the plan by focusing on the largest impact risks first and what to do with them. Then move to lesser exposures that your business faces. All the while you want to assess how you are doing in each area in case you need to make adjustments.

Focusing on true risk management within your business will give you the ability to confidently plan and budget for the uncertainty as well as become more profitable because you have reduced the cost of theft off the lot and accidents/injuries. Insurance should be part of this process, but should NOT be relied on as the only method of risk management.

Because working with dealerships is all that we do, contact DealeRisk to have one of our team members help you create a solid risk management plan.

Recent Comments